Dynamic rates on leverage optimize capital efficiency for all participants

Dynamic rates on leverage optimize capital efficiency for all participants

At all times, each liquidity pool has an independent metric describing the utilization of its liquidity. It is calculated as a ratio between the aggregate deposits in that pool and aggregate debt drawn from this pool. The debt includes every type of borrowing positions, including liquidity taken out by the Leverage Protocol. To rephrase, utilization ratio always reports the amount of liquidity available on the spot, relative to the aggregated deposits.

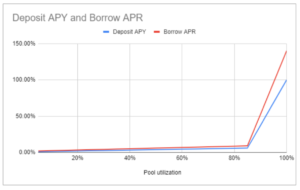

At launch, the target utilization ratio is set to 85% for each asset, which the protocol incentivizes by dynamically adjusting interest rates for both lenders and borrowers linearly, depending on pool utilization (diagram below).

Figure 1: AAlf dynamnic interest rate

Target ratio and the slopes depend on multiple parameters and will be adjusted by Alf Council as trading data over the corresponding assets accumulates. The model pursues three goals:

- Ensure protocol solvency at all times. Underlying assets and liquidation markets are prone to price action and volatility. Despite that, the collateralization level invariant must be kept, enacting prompt liquidations between the time any particular position enters endangered state and the time when its collateral is worth less than the safety margin.

- Enable frictionless deposits and withdrawals. Ideally, if a liquidity provider in AAlf closes her position, she should be able to withdraw her entire deposit on the spot, even if it is considerable in size. For a lending pool, this means that reasonably sized inventory should be kept on hand by the protocol, and once a withdrawal happens, the added incentives (shifting interest rates) should motivate other stakeholders to promptly adjust the utilization ratio to its target value, eitehr providing additional liquidity, or closing some of the loan positions.

- Maintain high capital efficiency. As long as the first two properties are main- tained, the protocol should minimize the amount of idle liquidity, i.e. liquidity that does not generate a yield. Idle liquidity reduces return rates for all liquidity providers, so it should be kept as low as possible, insofar as it does not threaten the solvency of the protocol.